2. Framework

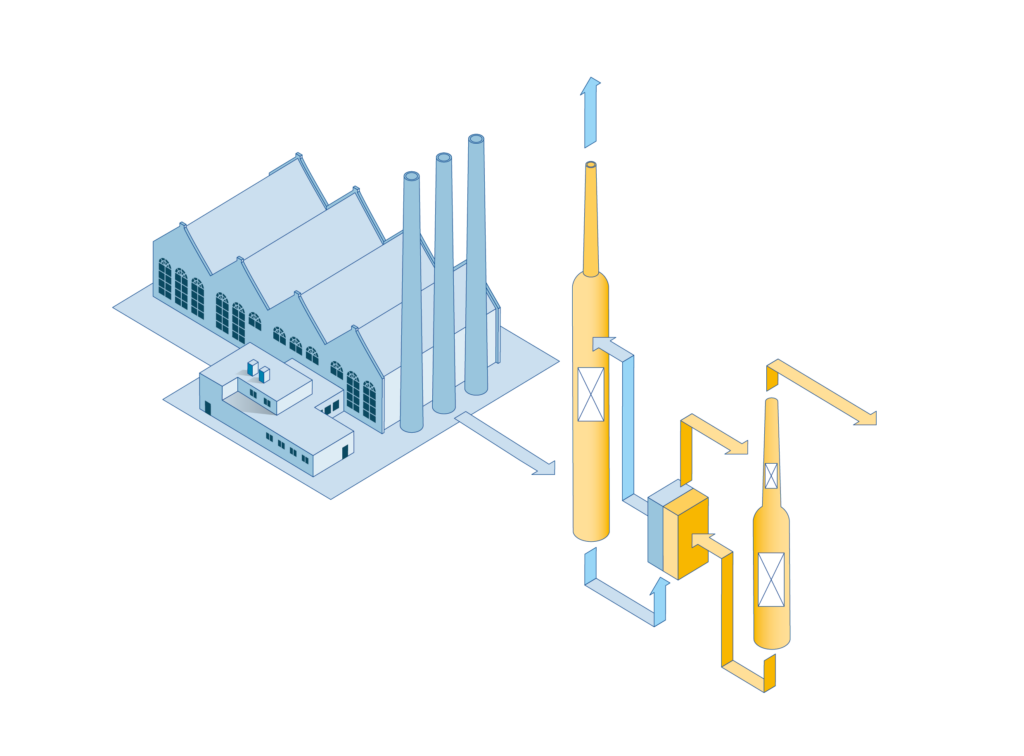

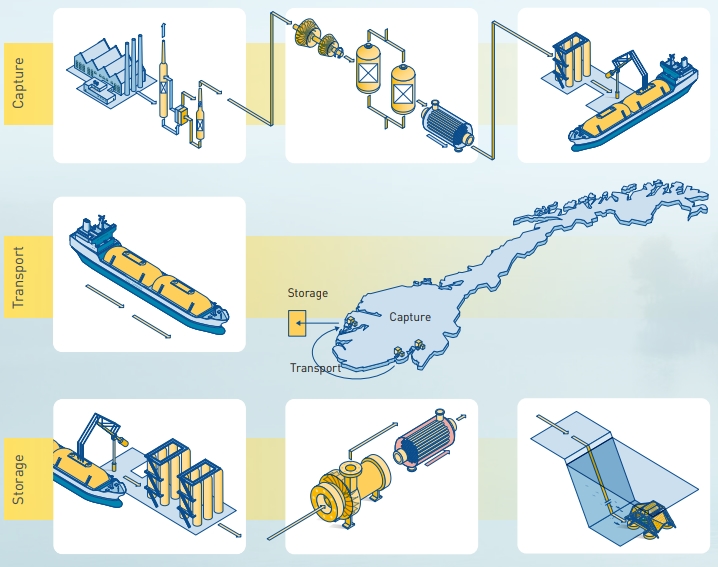

Based on feedback from the industrial partners in the early in the process, the CCS chain was split into the three individual areas of capture, transport and storage. Longship was therefore organized as several individual sub-projects, led and executed by the industrial partners themselves, but within a framework coordinated and integrated by Gassnova. The different parties have only been responsible for activities within their areas of competence and business, while the state carries the full-chain risk. This has been a key factor for successful development of an integrated CCS chain.

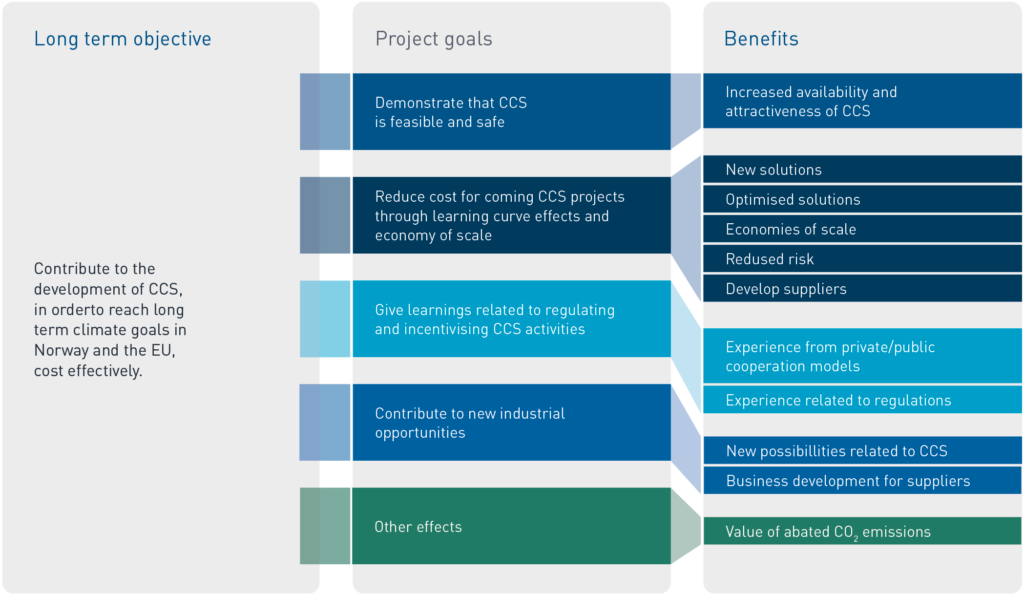

The long-term objective of the project is to contribute to the necessary development of CCS, in order to meet long-term climate goals in Norway and the EU in a cost- effective manner.

Project goals defined by the government:

- Demonstrate that full-scale CCS is feasible and safe.

- Reduce the cost of future CCS projects through learning curve effects and economies of scale.

- Generate learnings related to regulating and incentivizing CCS activities.

- Contribute to new industrial opportunities.

The Revised National Budget for 2018 underlined the importance of bringing the cost down and increased the likelihood of the Norwegian CCS chain becoming relevant for other European capture sources.

In order to strengthen the industrial approach of the project, it has been left to each industrial partner to define and develop their project according to their best interpretation of the project goals.

In major decisions made by Gassnova, the emphasis has been on the first project goal, as any other goal is dependent on a successful demonstration. An example of such a decision is to transport the liquid CO2 at the same pressure and temperature as used commercially today. While it is theoretically possible to achieve more cost-efficient transport at lower pressure/ temperature, it would raise the complexity and risks in the project development.

As the project goals describe the desired effect rather than specific and measurable targets, this has led to different interpretation of the project goals among the On the one hand, this has allowed the partners to develop their projects to fit better with their business rationale. On the other hand, this has led to challenging discussions between Gassnova and the industrial partners regarding design performance.

Defining clear project goals using g. the SMART principle and ensuring alignment between all project stakeholders should be given a high priority in early phases. This is particularly relevant for projects with a complex stakeholder environment, as is typically the case with CCS projects.

Based on feedback from the industrial partners in the pre-feasibility phase, the CCS chain was split into the three individual areas of capture, transport and storage. The main purpose of this division was to allow the emission source owners to focus on the capture element alone, without being burdened with the development of transport and storage solutions.

Longship has therefore been organized as several individual sub-projects, led and executed by the industrial partners themselves, but within a framework coordinated and integrated by Gassnova.

This setup has left the risks associated with the development of the interface between the sub-projects to the state.

The work performed by the partners has been executed in line with study agreements with Gassnova, with significant state aid. Although the realization of the CCS chain will be largely publicly funded, the Norwegian state will not have ownership of any facilities or infrastructure. In order to allow the project to be developed on industrial terms, the degree of freedom given to the partners is significant, and the various sub-projects have been developed as the respective partners have seen fit.

A technical committee with participants from Fortum Oslo Varme, Heidelberg Materials, Yara, Northern Lights and Gassnova has met on a regular basis (from the start of the concept selection phase) to discuss topics of common interest (e.g. related to CO2 specification, export rates from the capture plants, use of loading arms between capture export terminal and ship, etc). Similarly, a committee for cross- chain operational aspects (e.g. principles for developing the ship transport schedule, how to handle off-spec CO2 during loading of the ship, etc.) was actively working during the last stages of the definition phase.

As a consequence of the project setup, a project integrator has been needed. This role has included responsibilities such as:

- Definition of, and follow-up on, the studies through the whole project, incl. development of the design basis for the CCS chain.

- Performing audits and verifications as needed.

- Evaluation of the deliveries from the partners at DG2 and DG3, incl. technical evaluation and ranking of the capture projects.

- Performing own HSE activities as HAZID and HAZOP for the interface between capture export terminal and ship for CO2 transport, and the CCS chain carbon footprint.

- Organizing risk-based quality assurance of deliveries (except the KS quality assurance).

- Developing and maintaining an overall project schedule.

- Coordinating the development of the interfaces between the various sub-projects, incl. management of a technical committee and an agreements committee.

- Advising and assisting MPE in commercial negotiations with the industrial partners.

- Analysing and managing project risk in line with recommendations given in NS-ISO 31000.

- Reporting to and preparing docu- mentation for the project steering committee (led by MPE).

- Increasing the industrial partners’ awareness of the risk of cross- subsidization.

- Coordinating and leading the work on benefit realization.

A small core team has been required from Gassnova to follow up on the study work from the feasibility study through FEED (organized as a small project team with traditional roles/disciplines such as project leader, project controller, HSE, technical experts, etc).

Dividing the responsibility for the CCS chain between the industrial partners doing capture, transport and storage has been a pre-condition for success, and has allowed the emission source owners to develop their business cases without having to establish their own transport and storage

The state has accepted the cost and risk associated with uncertainties in the interface between capture and transport/storage. This is one of the key principles for the operating phase.

To coordinate and facilitate the development of the CCS chain, it has been important for the state to retain the project integrator role via

Establishing committees with participants from Gassnova and all the industrial partners has allowed free discussions on topics of common It has been very useful in terms of aligning the CCS chain and has led to more efficient and predictable interaction between the partners.

Managing the interface between capture and transport/storage has required a fine balance between widely differing company cultures and practices (major oil companies on the one hand and producers of commodities and heat/energy on the other). Different expectations concerning work processes, level of detail in deliverables, resource use, etc. have created frustration for all parties.

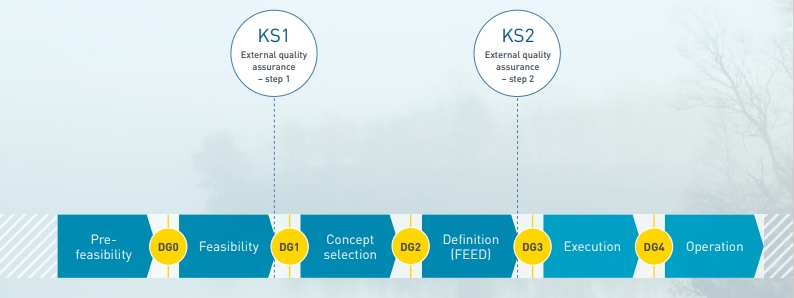

The project has been developed according to best practice project management methodology for large industrial projects, as illustrated in Figure 1. To efficiently explore possibilities and make informed decisions at the right time as the project matures, working through a well proven model is very helpful. Each phase in the project development has defined deliverables and ends at a decision gate (DG) before moving into the next phase. To ensure that the deliverables from the different industrial partners aligned with Gassnova’s expectations, guidelines from the American Association of Cost Engineers (AACE) were used as a frame of reference. Gassnova and the industrial partners have used similar project development models, although the name of each phase and the decision gate (DG) numbering differs slightly.

At each decision gate, every partner has had the chance to abort their own project; however, the overall decision to provide state aid for the next phase has resided with the government.

Figure 1: Stage gate project development model, also showing the timing of the external quality assurance required by large public projects in Norway (KS1 and KS2).

The overall timeline for the project is shown in Figure 2.

Figure 2: Overall timeline of the project, from start of the pre-feasibility phase to start of operating phase.

As shown in Figure 2, different parts of the project have been developed according to somewhat different time-schedules. In particular, the development of the transport and storage sub-project has taken more time than originally envisioned. A change of storage location within the Hordaland Platform region from Smeaheia to Aurora and an unforeseen need for a test well to verify reservoir properties prolonged the concept study and the FEED study, respectively.

The traditional stage gate project development model shown in Figure 1 has been applied with success. Thanks to the widespread knowledge of this model, all parties involved in the project have been able to relate to the typical scope of work, deliverables, accuracy of cost estimates, etc. This has generally helped maintaining a high quality in deliverables and has made cooperation between different companies easier.

It was necessary to use a common frame of reference for the objective of each project development phase. Using the recommended practices from AACE has been successful, and the “Recommended Practice for Cost Estimation Classification” (18R-97) has filled this purpose very well.

When developing geological storage for CO2 it may be difficult to use the typical work processes major oil & gas companies normally follow when they develop projects. The Northern Lights partnership had to adapt its development model to reflect differences from its traditional projects given that there are no valuable resources in the ground, no business model or market thus far, etc.

With independent sub-projects following different schedules and project external processes related to the state aid, it has been challenging to develop the project along a typical industrial path. A high number of critical decisions have been made throughout the project development; decisions that often have been mutually dependent on each other and taken by different companies or by the government. This has required transparency and flexibility from the involved parties but has still led to unplanned periods with lower activity.

According to established industrial practice, selection of technical solutions is closely connected to cost and commercial aspects, and the project framework should therefore be developed as early as possible in the project development process. However, this was not possible for this project due to the commercial and regulatory immaturity of CCS. The staged development has in itself been instrumental in the stepwise establishment of trust between the government and the industry, allowing both technical and commercial aspects to mature in parallel.

Based on the Norwegian Environment Agency’s list of emissions of CO2 from land-based industry, Gassnova performed a study in 2012 mapping the potential capture of CO2 from existing Norwegian emission sources. Around 30-35 sources were emitting more than 100,000 tonnes of CO2 per year, comprising oil refineries, gas processing plants, petrochemical plants, cement factories, metal processing plants, etc. A selection of potential future emission sources was also considered. In line with the Global CCS Institute’s definition of “large scale”, 400,000 tonnes of CO2 per year was set as the least amount of CO2 to be captured. This reduced the number of relevant emission sources to 14.

Through a dialogue with their owners, these emission sources were further screened based on technical, commercial, and financial aspects, including the owner’s interest and rationale for engaging in the capture of CO2.

The final list of emission sources that were considered relevant for the capture of CO2 was a short one: Yara’s ammonia plant at Herøya and Heidelberg Materials’s cement factory in Brevik were the only existing plants, plus a few potential future plants.

From 2014, owners of existing land-based emission sources in Norway have been invited to carry out the necessary studies to mature CO2 capture plants, starting with pre-feasibility studies, followed by feasibility studies and subsequently combined concept and FEED studies. Apart from Yara and Heidelberg Materials, only Fortum Oslo Varme (then known as Energigjenvinningsetaten and owned by the City of Oslo) tendered for these studies. All three companies were awarded study contracts with Gassnova. The CO2 emissions from Fortum Oslo Varme’s waste-to-energy plant at Klemetsrud were lower than 400,000 tonnes per year, however Energigjenvinningsetaten carried out a pre-feasibility study on their own initiative and at their own expense. The study showed that capture of CO2 at Klemetsrud have the potential to generate valuable learning in line with the government’s goals. Plans to ramp up the waste incineration capacity were also presented, increasing the amount of CO2 to be captured to 400,000 tonnes per year.

After the concept studies on capture was completed it was decided that Yara where not continuing with a FEED study on capture from the ammonia plant at Herøya, mainly because the future production volume of ammonia is uncertain and the technical solutions had limited learning effect for others.

The development of the CO2 storage had a different start than for capture, as the number of potential storage operators in Norway is limited. Following a public procurement process, all companies qualified as operators for petroleum operations on the Norwegian continental shelf were allowed to tender for the feasibility study on CO2 storage. Only Statoil (now Equinor) submitted a tender and was consequently awarded the study agreement. Following the completion of the feasibility phase, qualified operators were invited to tender for combined concept and FEED studies on the storage of CO2. Statoil and Total submitted tenders, but only Statoil was awarded a contract. Shortly after the award, Statoil, Shell and Total formed the Northern Lights partnership.

From the initial stages of the project, transport of CO2 has been viewed as mature and available for procurement in a functioning market.

Through the feasibility phase and concept selection phase, Gassco had the responsibility as a neutral party to define and coordinate the study work. After completing their concept study, the responsibility for the transport sub-project was transferred to Northern Lights, through an option in the study agreement.

Except for Yara, all the industrial partners involved in the early phases of the project are still involved and have taken their FID’s. Given the objective of the project, the strategy to map all existing emission sources in Norway and aim for capture from the sources of significant size and with a strong self-interest in doing CCS, has been

The establishment of the Northern Lights partnership by Equinor, Shell and Total has given access to world-class expertise, including experience from ongoing commercial CCS operations. The Northern Lights partnership also represents companies that are in a good position to bring the learnings from the project into new projects.

Based on Gassnova’s experience from the early mapping and screening, typical reasons why the industry might consider CO2 capture unattractive are:

- Cost of capture perceived as very high compared to alternatives (e.g. CO2 quotas has been available at very low cost)

- Unclear what kind of climate regulations and policies that will be set out for industry in the future and when investment barriers and risks related to the whole CCS chain.

- Each part of the CCS chain is dependent on successful development and operation of the other parts of the chain. The value of capturing CO2 is low or even negative if there is no transport and storage operator available to store the CO2 according to relevant regulations

- Low CO2 concentration in exhaust gas or many dispersed CO2 emission sources (e.g. aluminium production)

- Uncertainty regarding business model (divided costs between the industry and the state)

3D illustrations

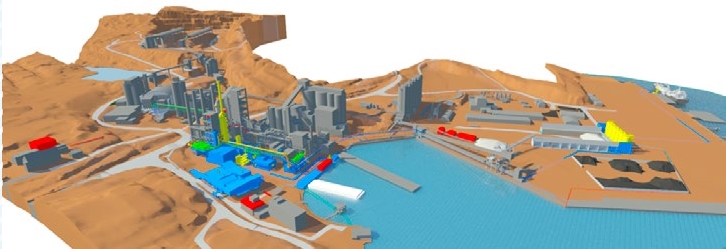

Heidelberg Materials’s existing plant (in grey) and the planned capture facility (in colors). Source: Heidelberg Materials AS

Fortum Oslo Varme’s existing plant (in grey) and the planned capture facility (in colors). Source: Fortum Oslo Varme AS

Northern Lights’ planned CO2 receiving terminal. Source: Equinor ASA

As documented in several reports, several barriers make investments in CCS unattractive for industrial parties. To obtain early industrial CCS investments, cooperation between industry and the public sector is needed, together with public financial support. Public-private cooperation has been important in handling specific investment barriers for CCS, especially related to cross-chain risks and overcoming an unfit and immature regulatory framework.

To facilitate this cooperation a project development process in stages has built trust between the private and public partners has been important.

CCS also needs state aid to compensate for market failures related to climate policy (the cost to industry of CO2 emissions is less than the socio-economic cost of these emissions) and technology development.

It is anticipated that CCS would require less technology-specific policy in the future as technology and markets evolve.

The need for state aid has raised several issues related to:

- Competition rules in the European Economic Area

- Norwegian legislation on public procurement

- Longer time between the project development phases to allow for necessary quality assurance and decisions on the government’s side.

Relying heavily on state aid, it has been important to make sure that the industrial partners understand the consequences and plan accordingly. Conducting procurement according to public procurement laws and obtaining approval from the ESA will require time and resources that are unfamiliar for most industrial projects. It is advisable to make legal assessments, to study relevant regulations, and to establish a dialogue with ESA as early as possible.

With a significant share of state aid it is a risk for the government that the industrial partners would design their CCS-facilities with excessive requirements to technical quality and performance (known as “gold plating”). Despite this, the CCS chain is considered to have an appropriate design. Factors like the competition between the capture projects, reasonable technical requirements from the state, and a strong desire with all parties to keep the cost down have been important in this respect.

One of the key principles for the governmental contract strategy is that the industrial partners in the project are most qualified to take full responsibility for planning, constructing and operating their part of the CCS chain. It was therefore decided early on to run the concept and FEED studies as a competition for state aid, with an option to carry out detailed engineering, construction and operation. In 2016, the feasibility studies were completed, and the competition for combined concept and FEED studies was announced later the same year.

The overall contract strategy from the government’s side is based on competition between the potential capture operators all the way up to completion of FEED, with the storage operator chosen before the start of the combined concept and FEED studies. Transport of CO2 by ship has been assumed to be a service that is available on a commercial basis in a functioning market. In order to reduce the number of interfaces in the project, the responsibility for the transport sub-project was transferred to Northern Lights after Gassco completed its concept study in late 2017.

Negotiations on the terms of the state support agreement for the construction and operation of capture, and transport/storage of CO2 started in 2017 in parallel with the concept studies. The MPE conducted negotiations with each industrial partner on behalf of the government. Establishing and agreeing on commercial terms proved to be complex and more time-consuming than anticipated, and the negotiations concluded in the first half of 2020.

Within the frames of the support agreement, each industrial partner has the sole responsibility to perform detail engineering, construction, start- up and operation of their part of the CCS chain.

The government has developed the state support agreements in such a way as to give the partners incentives to act in line with industrial practices throughout the construction and operating phases. However, the agreements allow the government to be hands-on during the follow-up of the project.

The risks and costs are split between the partners and the state, with significant contributions from the partners.

One of the main principles behind the state support agreement is that the state will provide funding to cover part of the actual costs, but only up to an agreed limit (corresponding to the P85 estimates). By capturing and storing CO2, the emissions from the capture plants will be significantly reduced, which will allow the capture operators to sell surplus CO2 quotas in the EU ETS. The state will also compensate the capture operators for the CO2 emissions that have been avoided but that are not covered by the EU ETS, up to 400,000 tonnes of CO2 per year. Since Northern Lights does not get any additional compensation to handle the CO2 from Heidelberg Materials and FOV, they will have to sell their surplus capacity to third-party paying customers in order to generate an income.

It has been necessary for the state to accept that the industrial partners will only enter a contractual relationship directly with the state, with no obligations towards the other partners in the CCS chain. The key operational principles that will govern the cooperation between the industrial partners are detailed out in a separate appendix to the state support agreement. The state has accepted to carry the risks associated with the operational cooperation between the partners and the potential extra costs incurred from potential delay of any of the sub-projects.

The competitive element between FOV and Heidelberg Materials has added value in several ways: Capture from industries with different potential to generate learning have been explored thoroughly; the quality of the deliveries from the competing sub-projects has been high; and the state got a stronger position in the negotiations.

When negotiating the terms of the study agreement for the concept and FEED studies on the transport and storage elements, the competition between several companies resulted in a larger financial contribution to the study

Since the commercial negotiations and FEED studies were conducted in parallel, the industrial partners had to set the design performance of their facilities without complete knowledge of the commercial implications. It is advisable to settle the commercial mechanisms earlier, if possible.

The competition between the capture sub-projects required strict formal structures to be in place and forced Gassnova to be careful in its feedback to the competing partners to ensure equal treatment. The competitive element has constrained open dialogue between the partners and made it hard to capitalize on potential synergies across the CCS chain. These are negative aspects of the competition, which should be taken into consideration when developing the contract strategies at a high level.

The plan to work on “benefit realization” alongside the ordinary project development gained traction as the first step of the external quality assurance (KS1) in 2016 concluded that the benefit side of the project was unclear and that they feared that no projects would gain from the learnings of this project as it was unlikely that other CCS projects would follow this project.

Gassnova was tasked with leading and coordinating a programme to maximize the benefit and value creation from the project. Benefit realization is a systematic work process to ensure that the benefits of the project is understood and that value-adding activities are carried out as the project matures and is realized. This work was led by Gassnova, with strong contributions from all the industrial partners and activities in the MPE. Gassnova will continue to coordinate this work in the realization phase.

Four main groups of benefits from the project have been identified: the demonstration effect, the cost reduction effect on subsequent projects, the effect of new business opportunities, and the effect of reduced CO2 emissions.

The benefit realization concept has been important to developing a common understanding of what the state wants to achieve through the project. The concept has been an important framework where all project parties (both industrial and public sector) have identified and carried out value-adding activities. This has been recognized in the external quality assurance report (KS2).

When the business development of an industrial partner aligns with the benefits realization work the results are strong. The work that Northern Light’s business development team has done has resulted in an impressive plan for developing the market and the infrastructure.

The benefit realization concept has been relatively new to all the project partners. It has sometimes therefore been misunderstood as a set of activities to advertise the project or CCS in general.